Engaging in financial services means that you are exposed to constant change. There is always something new in this industry— AI’s increasing role, new market regulations, and ever-changing consumer preferences. Adapting to these changes, however, requires that you also modify your existing systems and models. You must always be able to circumvent your workflows, no matter how well-established they may be so that you won’t get lost in the tide.

One way companies are keeping up with the constantly changing conditions of the financial services industry is by implementing agile approaches to their operations. In this article, you will learn the basics of Agile, and why it may be the secret to your future success.

What is Agile?

Introduced in the Agile Manifesto, Agile is a set of principles, theories, and values aimed at uncovering ways to deliver value and collaborate with your customers. Since its publication in 2001, the Agile approach has helped organizations to increase customer responsiveness, collaborate across organizational functions, and practice radical ownership.

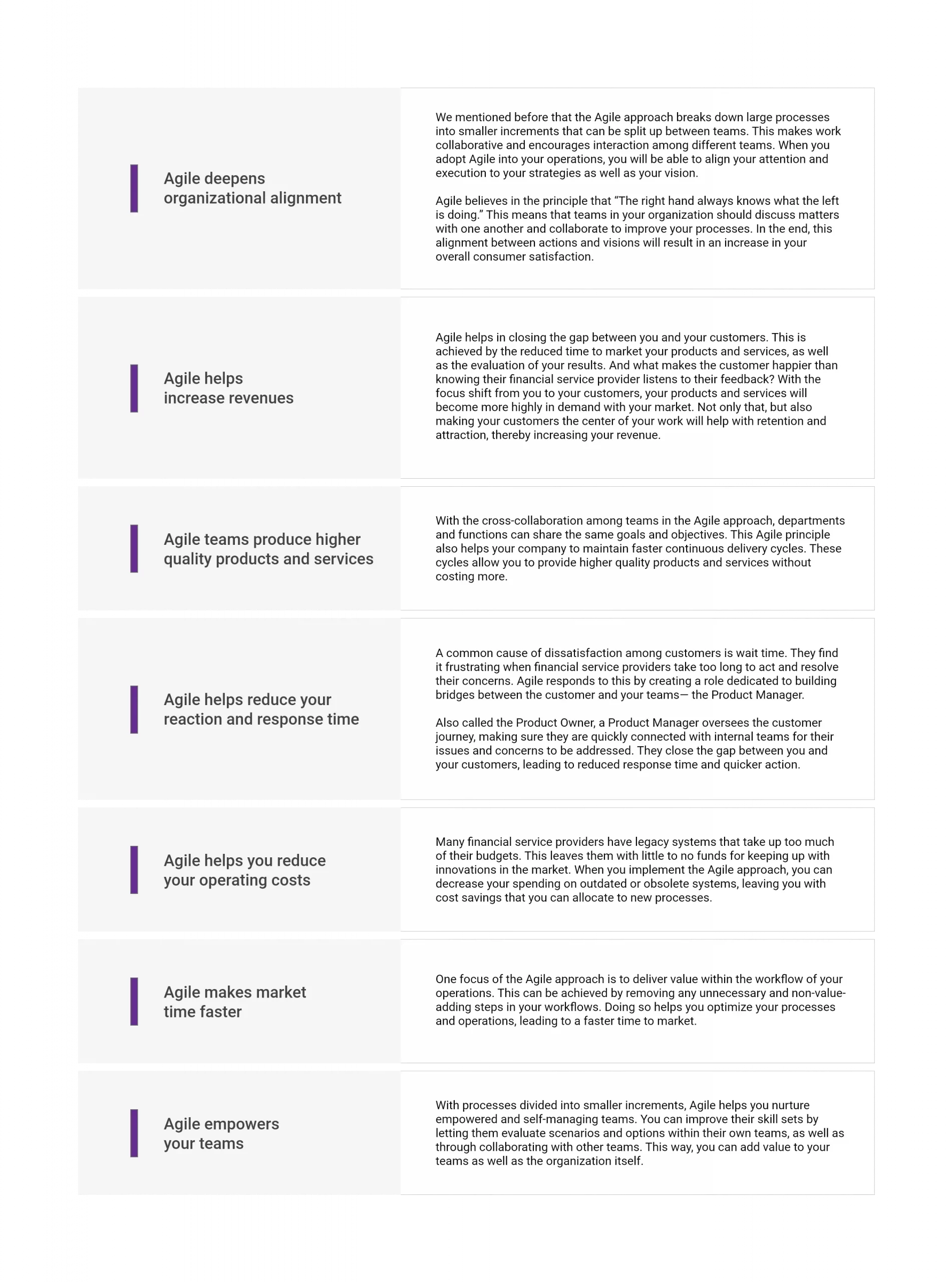

The Agile approach breaks down large processes into small parts for continuous delivery. This means that evaluations of requirements and results are done in a shorter timeframe, resulting in a closer relationship between you and your customers.

Can Financial Service Providers Implement the Agile Approach?

Definitely. Agile found its roots in the software industry, however, organizations in various industries and fields have successfully adopted the approach in their operations. Despite its widespread use, financial service providers seem to be reluctant to implement the Agile approach. This is because those in the financial industry tend to implement traditional methods of management focused on standardization. Financial service providers commonly have a top-down approach to management, meaning that leadership decides on action plans and strategies. Employees must simply follow the plans that top management has set. This makes financial institutions heavily siloed, leaving employees with a transactional way of thinking.

As we’ve mentioned before, the financial services industry is faced with constant changes brought about by several factors. Financial service providers may find it difficult to keep up with the changing market conditions if they continue to use traditional management methods. This is why it is important that you lean into new and innovative ways of handling your customers’ needs such as Agile.

Why Agile?

Technology companies are not the only ones that can benefit from taking the Agile approach in their operations. Financial service providers can also take advantage of Agile principles to provide customers with seamless experiences, leading to customer satisfaction. Here are some reasons why you should adopt the Agile approach.

Implementing Agile in Financial Services

Just like what it did for the software industry, Agile has the potential to completely innovate and revolutionize the financial services industry. It can help organizations to keep up with the constantly changing market conditions and consumer preferences. However, you must keep in mind that no company implements the same set of Agile methodologies. This is because organizations have different complexities as well as needs and requirements. Here are some proven strategies when implementing Agile in your operations.

Nurture leaders toward alignment

Although Agile creates empowered and self-managing teams, it is still important to delegate a leader who aligns the team to upcoming changes. This way, your teams can have direction and any roadblocks to success can be removed for both the customers and the employees. A leader also makes sure that the Agile framework that you adopted gets properly implemented and improved.

You can start to nurture your Agile leaders by helping them deeply understand Agile itself. You need to communicate to them what Agile is, and why it is important that your organization adopts the methodology. When they can fully understand your intent and the Agile methodology, they will be able to foster successful Agile teams, and eventually create a self-managing and empowered team.

Define what you envision your organization to be

Before you can decide and implement an Agile methodology for your organization, you should first define what your goals are. Envision what you want your organization to be as this becomes a basis of what Agile strategies you should adopt. Ask yourself, “What do I want my organization to be in the financial services industry?”

Recognize your customers and their journeys

When we say “customers,” we don’t necessarily mean the end-user or the consumer of your products and services. Anyone who accepts the work is considered a customer in the Agile approach. This means that they can be an internal unit in your organization such as marketing or legal, or external persons such as regulating bodies.

You can recognize your customers and their journeys by researching what they need. From here, you can create a customer journey that visualizes their experience at each point of their transaction. This way, you can retain the customer as the center of your organization while also driving your teams towards improvement.

Foster a work culture that centers on Agile

A fast shift in management methodologies can cause culture shock among your teams. After all, they will have to adjust to the new processes and methods in doing their work, especially if they were used to a highly structured, command-and-control type of management. Since Agile is not just a process but a way of thinking, you should be able to foster a work environment that encourages learning, collaboration, understanding, and flexibility.

Help them understand what Value Stream Mapping (VSM) is

A value stream is a set of actions that take place to add value for the customer in their whole customer journey, from their initial request to their realization of value. This also includes the people involved in the customer journey as well as the materials and tools used in fulfilling the customer’s request.

When adopting the Agile approach in a financial institution, it is essential that the people involved know what their value stream is. This is because every aspect of a financial institution involves complexity, regulatory risk, and compliance. You can help them learn and understand what a value stream is through a Value Stream Mapping (VSM) workshop. By doing so, you can identify your Agile teams as well as your portfolios.

The Final Say

Agile has revolutionized how organizations across many industries deliver their products and services to their customers. Even within our rapidly changing society, Agile has proven that its principles and methodologies can help organizations become frontrunners within their industries. This is the same with financial services providers. The ever-changing market calls for the financial industry to come out of its traditional methods and try new ways to innovate its services and operations. You can use this as a guide in adopting the Agile approach to your organization so that you can lead the market with the help of your teams.